The best business & lifestyle stories from the North East and Yorkshire sent directly to you

As a first-time buyer, putting a first foot on the property ladder is an exciting prospect, but can also be a nerve-wracking experience. Before finding a property, it is important to recognise what is affordable, as well as understanding what lenders will allow you to borrow.

Unless you are able to buy a home outright, a property purchase will most likely be made up of a deposit and a mortgage for the rest- meaning that the buyer will need to borrow money from a mortgage provider. Different providers offer different rates and types of mortgages, each of which comes with interest on the money borrowed. It is useful to have a decision in principal when looking for a new home. Many sellers and estate agents won’t accept an offer without one. This is an initial agreement that (in principal) the lender is prepared to grant you a mortgage, and a qualified declaration of how much they may let you borrow. When applying for a mortgage, there are several tasks to complete which could encourage better results, including the acceptance of an application or better interest rates. They include;

• Electoral role – It could negatively impact your credit score if you aren’t on the electoral role

• Check your documents are all in your correct name with your up to date address on. Lenders can ask for anything and everything to satisfy their underwriting requirements so having access to accurate documents is essential.

• Review your credit file. Use an online credit reference agency to ensure your credit history is correct. It’s easy to forget about any ‘black marks’ on a credit file – which could result in you being declined for a mortgage.

Get rid of bad habits – when you apply for a mortgage, lenders will look at your income and your outgoings. This may involve you needing to make small financial adjustments to demonstrate that you are a safe spender.

• Proving income – pay slips and bank statements from the last three months are usually required when applying for a mortgage. If you are self-employed, you will need copies of your tax returns and business accounts.

• Aim to avoid missing payments or paying late by setting up direct debits.

• Try to keep your financial position as stable as possible in the months running up to a mortgage application. Avoid opening new accounts and taking out new credit facilities.

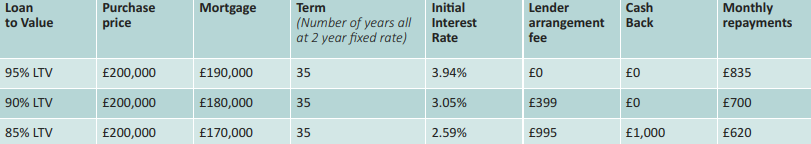

To support first time buyers in achieving the important milestone of stepping onto the property ladder, the government recently introduced a new mortgage guarantee scheme. Launched in April 2021, the scheme assists first-time buyers with small deposits by protecting lenders if the borrower fails to pay. This will increase the availability of 95% loan to-value mortgage products, enabling more buyers to access mortgages without the need for prohibitively large deposits. The COVID-19 pandemic led to a reduction in the availability of high loanto-value (LTV) mortgage products, particularly for prospective homebuyers with only a 5% deposit – leaving many unable to get onto the housing ladder. The government announced the mortgage guarantee scheme, supporting the next generation of homebuyers. The 95% mortgage scheme will run for 18 months until December 2022 and applicants must have a regular income, a good credit rating and show that they can afford the monthly mortgage repayments. Bradley Hall’s mortgage team will unlock the best deal possible for their clients whilst also managing the application from start to finish, collecting and analysing all of the required information including credit history, deposit size, preferred monthly repayments and pair you with a tailored and bespoke solution which meets all of your needs. Our expert mortgage team has scoured the market to find the best example deals for low deposit buyers*

*accurate at the time of print

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage.

If you would like more information on our Mortgage services or would like to find out how much you could borrow, please contact our expert Mortgage team on 0191 260 2000 or email [email protected]

For more information head to www.bradleyhall.co.uk